When you are into stock market investing, it is important to learn do to basic stock market analysis. By learning how to analyze the market movement and able to follow what the market analysts are saying, you are way better of getting and making a well-informed investment strategy.

Practicing analyzing the market while new to investing, makes one become more efficient in the long run.

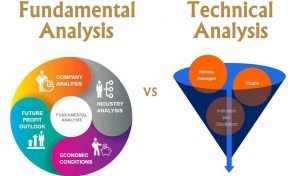

Generally, there a few types of stock market analysis and we will be explaining the basics below which will include the 2 most popular types of analyzing stocks, the fundamental and technical analysis.

Additionally, we will also cover some type of analysis which are not really popular but they can help a lot in case you want to use them. But, the mostly used types of analysis are the fundamental and technical, the others mentioned can be categorized under these two.

Widely Used Stock Market Analysis Methods

- Fundamental Analysis (FA) – This method of stock market analysis is typically geared towards a beginning investor, although advanced investors find it more interesting and helpful as well. The objective is to determine whether the stock or share price of a specific company you want to buy shares is correctly based on the present stock price.Analyst use this form of stock analysis by using factors such as the company’s financial status as well as the current economic condition, when valuing stocks. This may include talking to a company’s reliable source to investigate how good is the company’s management as well as its future plans.In other words, stock analysts consider buying stocks or shares from a company is actually buying a portion of that particular company, and also it refers to the two type of investors, the value and growth investors.Value investors prefer stocks where the market capital is less than the company’s liquidation value. On the other hand, growth investors will look at the company’s future, its marketing strategy and future products.

- Technical Analysis (TA) – This form of analysis is generally based on the evaluation of the company’s recent or current trading movements, as well as market trends attempting to predict the stock price. Here, analysts use charts to analyze a company’s stocks, looking at the resistance and support levels, hoping to predict the next price movements.By the way, support level is the price level in the chart which finds support so that the price won’t fall further down, this level is usually at the bottom of the chart, while the resistance level is the price level at the top of the chart at which it could rise or go higher than the current price.Analysts use charts along with trends and patterns for predicting stock prices. Technical stock market analysis is geared towards expert investors who already know or familiar most of the market movements.In other words, their experience makes them more efficient in using this kind of analysis as they can combine the data obtain from both fundamental and technical analysis. Day traders or the short-term stock investors always use the technical analysis approach of analyzing which good stocks to buy or invest in.

Other Types Of Stock Market Analysis

- Quantitative Analysis (QA) – In this kind of stock market analysis, the analyst analyzes a company based on specific figures or numbers and the analysis is purely based on facts as well as non-emotional. Among the figures to be based are the company’s income, its cash flow or past stock prices, or a combination of all these gathered data. Virtually any quantifiable factor can be use as a basis when analyzing stocks using this approach.

- Macro Analysis (MA) – This is mainly concerning government economic related policies plans, including the state of the national economy. As you know, government policies can hugely impact a country’s economic conditions and can generally impact the the stock market as well. Among the basis when doing the analysis are; how stable is the country’s income, nation’s economic growth, inflation and interest rates, political condition and stability and national per capita income.

- Sectoral Analysis (SA) – Here, a specific sector or industry is analyzed about its performance, its future and how it performs in the current market situation. For instance, the mining industry, it is closely examine how the mining industry would perform in the years to come, are they stocks from company’s involving mining doing well. Another popular sector or industries are the oil and energy industries.

These are the stock market analysis methods whom analysts are using when analyzing or valuing stocks for certain companies. We’ve seen analysts reporting on financial news, predicting a company’s stock price and many others, all these because of these market analysis methods we’ve mentioned.

Now, these approaches aren’t only meant for professional or expert stock analyst. We as individual investor can use for our personal analysis on the stocks we are investing in, and perhaps compare our analysis to the analysis made by the experts.

Learning how to analyze the market can help make the next investment moves more accurate and the risks can be minimized or well-calculated, though the data obtain using the stock market analysis, we can consider this as somewhat a market intelligence.